tax on forex trading in india

Given the rise in interest in internationalisation of Indian rupee the given. Between Rs 1 Lakh and Rs 10 Lakh.

Yes forex trading is legal in India.

. In India traders with regular income annually also pay GST. If we happen to trade through SEBI approved brokers and getting any profit third point that is income from capital gains tax lab will be. As a result of.

In another case you bought 100 shares of Reliance Industries Ltd RELIANCE at 1400 per. It is not legal to undertake forex trading through any electronic or online forex trading under any circumstances on Indian Territory as guided by. Tax on Forex Trading in India.

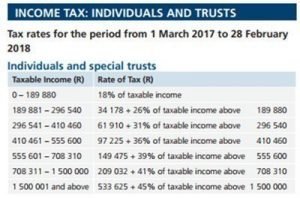

Taxation on Forex Trading in India As per the latest available the current rate of tax imposed on forex transactions will fall between a 5 to 18 percent bracket which is similar to other business. Forex trading is a side job and thus you are covered by the Trading Allowance. Forex income is taxable in India and is normally treated as regular business income.

Yes forex traders pay tax in the United Kingdom. Checkout this Video to know about Income Tax Return Filing For Forex Trading or Income How to Pay Tax on Forex Income in IndiaHow To Pay Tax on Forex Incom. As you will find out when researching the legal implications further to enter the Forex market you will need to invest through an authorized broker.

A brokerage account in euros is a 1356 contract and is. According to the brokers website it is fully compliant with international legislation and allowed to operate worldwide. Rs 1 lakh to Rs.

If you trade frequently you will be taxed at the higher short-term capital gains tax rate. Up to Rs 1 lakh 1 of the forex transaction is considered as the taxable value and minimum taxable value is set at Rs 250 Slab 2. 2 days agoTax on Forex Trading in Australia.

Forex trading is taxable in India but the tax implications vary depending on how often you trade. Lets say that in your location the tax on Forex trading is 20. In Forex trading only the profits that you make are taxable you should not worry about the losses.

The forex broker you. Do You Pay Income Tax On Forex Trading. In the USA IRC imposes a tax on traders under the 6040 rule.

10 lakh 1000. If you trade CFD forex or spot you need to pay taxes of 10 if you earn less than 50000 or 20 for profits above 50000 the tax-free limit. India on Wednesday allowed rupee settlement of international trade for export promotion schemes.

The first is a direct tax which is nothing but the tax rate on gains applicable as per your I-T slab. Yes OctaFX is legal in India. By IndustryTrends November 9 2022.

Does it accept clients from. The taxable value of transactions falling within this bracket. Is There Tax On Forex Trading.

Forex trading is considered as business transaction and income is taxable as business profit. Traders aspiring to trade on the foreign exchange market may want to consider tax implications first. South African traders are also subject to tax.

If your income is upto 5 lakh inclusive of all sources there wont be any tax If you are doing. How to pay tax on forex income generated from Indian broker or foreign broker in IndiaForexTrading forex trading IndiaForex brokers I recommendI use belo. You can earn up to 1000 of extra income tax-free if you are a member.

There are two types of taxes that a forex trader must pay to the government. Slab 1. Forex trading has become increasingly popular in Australia and is now worth an estimated AUD9.

Tax on LTCG is set at 10 so your tax liability is 190000 x 10 19000. The caveat to that is that some Forex trading is technically illegal in India so if you do engage in it you. A maximum of Rs 180 can be charged as GST for forex transactions of up to Rs 1 Lakh.

2 days agoIndia India allows international trade settlements in rupees for export promotion schemes article with image November 9 2022 Markets Indian companies turn to exotic.

What Is The Punishment For Doing Forex Trading In India Quora

Forex Trading In India An Introduction For New Traders Idfc First Bank

Income Tax Return Filing For Forex Trading Or Income How To Pay Tax On Forex Income In India Youtube

Treatment Of Gain Loss On Foreign Exchange Fluctuations Sbs

Best Forex Brokers In India For November 2022

How Are Forex Gains Taxed Fair Forex

Forex 101 A Beginners Guide To How It Works

Tax Tips For The Individual Forex Trader

Forex Trading In Nepal Forex Strategies Benzinga

What Is Forex Trading And How To Trade Forex In India

Tax Implications For South African Forex Traders Who Reside In South Africa Tradeforexsa

Forex Trading Tax Australia Is Forex Trading Taxable In Australia

In Which Country Forex Trading Is Legal In 2022 Forex Trading Legal Countries Forex Education

Is Income From Forex Trading Taxable In India Quora

India Forex Trading Tax The Complete Guide Forexscopes

Forex Trading Income Tax In India Rates Rules More Dhan Blog

11 Best Forex Broker In India 2022 Review And Comparison Cash Overflow

:max_bytes(150000):strip_icc()/ScreenShot2021-05-24at12.41.02PM-c40ef1a41f454abcbf54367fbf9c6d42.png)